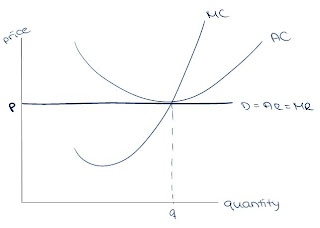

With the help of a diagram, explain how it is possible for a firm in perfect competition to earn abnormal profits in the short run.

The short run is the period of time in which the plant size of the firm is fixed, and firms are unable to enter or exit the industry. In a perfectly competitive market, firms are price takers, meaning that they must accept the market price that occurs naturally depending on demand and supply. If a firm is earning abnormal profits in the short run, it means that they are more than covering their total costs, including the opportunity costs. Where MC=MR, the quantity produced by the firm is maximized. At q, the average cost is C and the average revenue is P, meaning that the average cost is less than the average revenue, so the firm is earning profit on each unit that they produce. The amount of abnormal profit is the shaded rectangle on the graph. Earning abnormal profits is only possible in the short run because in the long run, firms can enter or exit the industry. The reason they would want to enter is because they realize that firms in that industry are earning abnormal profits, and are eager to earn abnormal profits for themselves. If firms enter or exit, there is a shift in the industry's supply curve which would cause the firm's price to decrease, eliminating its abnormal profits. Since the short run is the only time when firms are incapable of exiting or entering the industry, it is the only period of time in which firms may earn abnormal profits.

With the help of a diagram, explain how it is impossible for a firm in perfect competition to earn abnormal profits in the long run.

The long run is the period of time in which all factors of production are variable, but the state of technology is fixed. In the long run, firms in perfect competition will make normal profits because even if the firm is earning abnormal losses or profits in the short run, the industry will always adjust in the long run until the industry is in equilibrium. Because an industry will always reach equilibrium in the long run, it is impossible for a firm in perfect competition to earn abnormal profits in the long run. Abnormal profit only occurs if the firm's average cost is less than the firm's average revenue, which is impossible in the long run. The reason why firms in perfect competition will always earn normal profits in the long run is because if a firm is earning abnormal profits or losses, the industry will "correct" that with firms entering or leaving the industry until a normal profit situation is reached. The reason why firms would enter the industry is since there is perfect knowledge and no barriers to entry, firms outside of the industry that could also produce the good will be attracted by the chance to make abnormal profits. After a number of firms have entered the industry, the supply curve will start to shift to the right, which causes the price to fall, since there is an indirect relationship between quantity supplied and price. Because the firms are price-takers, the price that they can charge will start to fall and their demand curves will start to shift downwards. So, any abnormal profits they were earning will be eliminated as the price decreases until the industry eventually reaches equilibrium.

Explain whether or not a firm in perfect competition earning abnormal profits is productively and allocatively efficient.

If a firm is earning abnormal profits it is not productively efficient, however it may still be allocatively efficient. A firm is most efficient if it produces at the point where MC= minimum AC. A firm is productively efficient if it uses its resources to its maximum efficiency by producing its product at the lowest possible average cost, so where P= minimum AC. If a firm in perfect competition is earning abnormal profits, it means that they are producing above the minimum AC, hence P is not equal to the minimum AC, so it is not productively efficient. In order for the firm to be productively efficient, the quantity it produces would have to decrease until the price is equal to the minimum average total cost. Firms are allocatively efficient if they are producing the optimal mix of goods and services that the society needs and demands. The price of a product sends a signal from the consumers to the producers about how much of the product is demanded. If the price is higher than the marginal cost, it signals that more output is demanded by consumers, and if the price is lower than marginal cost, it is a signal from consumers that less output is desired. If a firm responds to these signals and are hence allocatively efficient, that means there is no under or over-allocation of resources towards a good. So, a firm in perfect competition earning abnormal profits can be allocatively efficient, but it is not productively efficient.